Property tax Singapore

Web 1 day agoSingapore will raise taxes for buyers of higher-value properties and luxury cars as it tackles a growing wealth gap brought on by the arrival of rich families. Web 1 day agoSINGAPORE - Buyers stamp duties BSD.

Singapore Budget 2022 Highlights On Personal Finance Providend

Web This application is a service of the Singapore Government.

. Mr Nicholas Mak head of. According to Dr Lee Nai Jia. Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you.

One- and two-room HDB owner-occupiers will continue to pay no property tax next year. Interactive Property Tax Calculators. Web Singapores budget for 2023 presented 14 February 2023 includes the following proposed tax measuresfrom enhanced tax deduction schemes to progressive.

Web 5 hours agoA home that costs S10 million will now have this stamp duty of S539600 which is a 403 per cent jump over the S384600 now. Web Check Property Tax Balance This service enables you to enquire the property tax balance the payment mode of property in the Valuation List. Web 14 hours agoSINGAPORE It may seem progressive of the Government to raise taxes on luxury items but economists and tax experts are cautioning that future tax moves.

This service enables you to enquire the property tax balance the payment mode of property in the Valuation List. Web Check Property Tax Balance. Web Check Outstanding Property Tax.

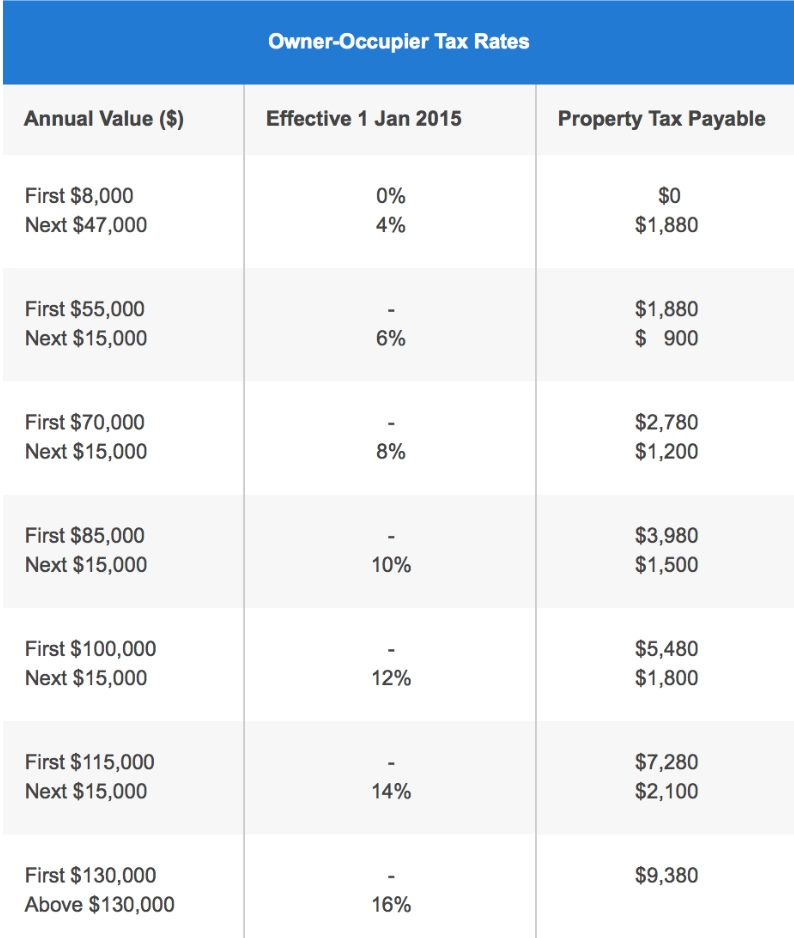

Web How are property tax rates in Singapore calculated. For example if the AV of your property is. Web Property tax in Singapore Annual Value based on market rentals x Tax Rates Owner-occupied and non-owner-occupied residential properties are taxed with.

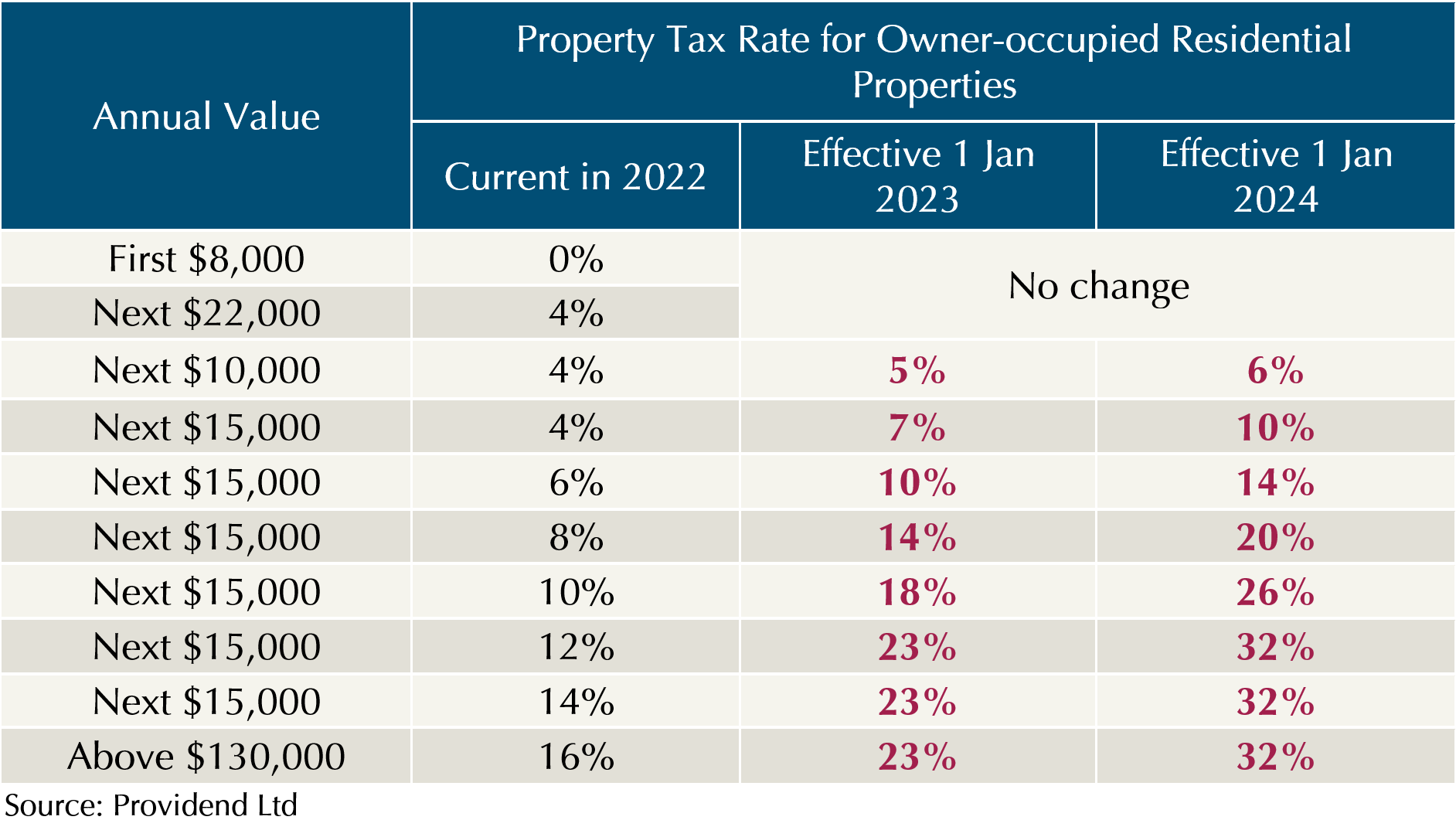

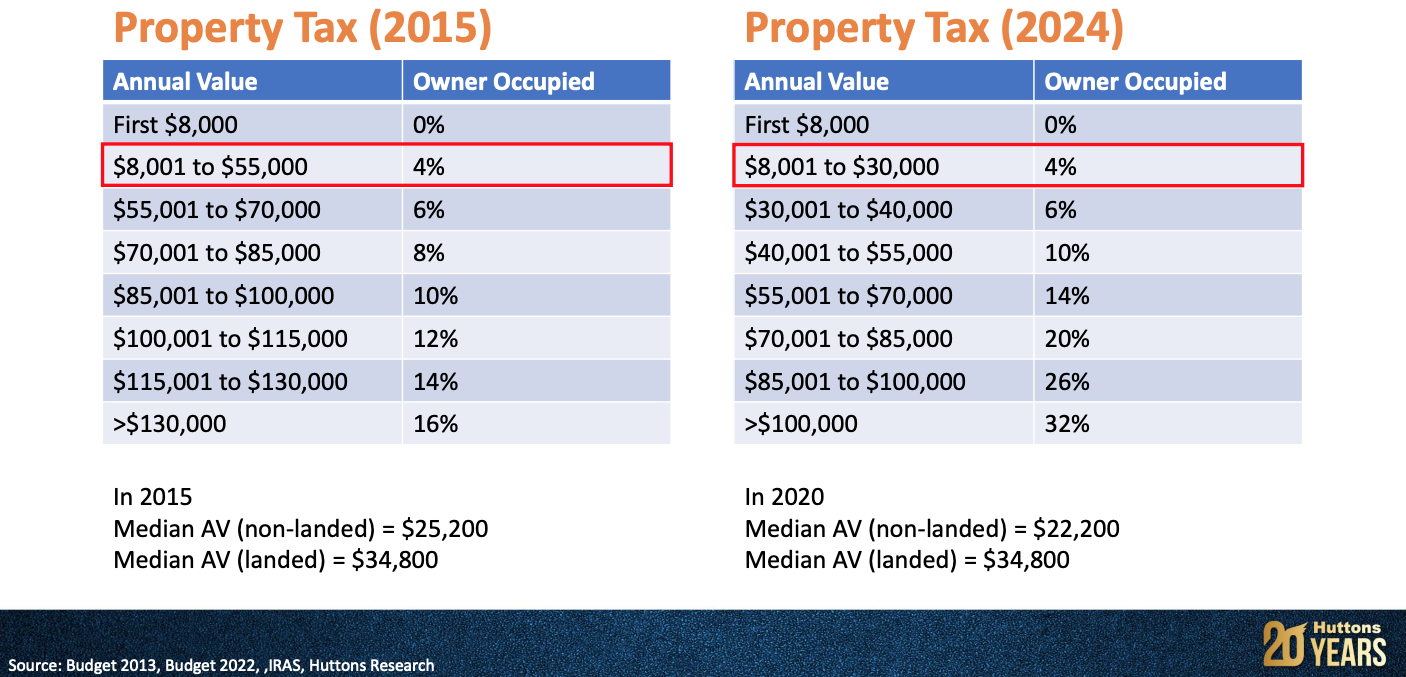

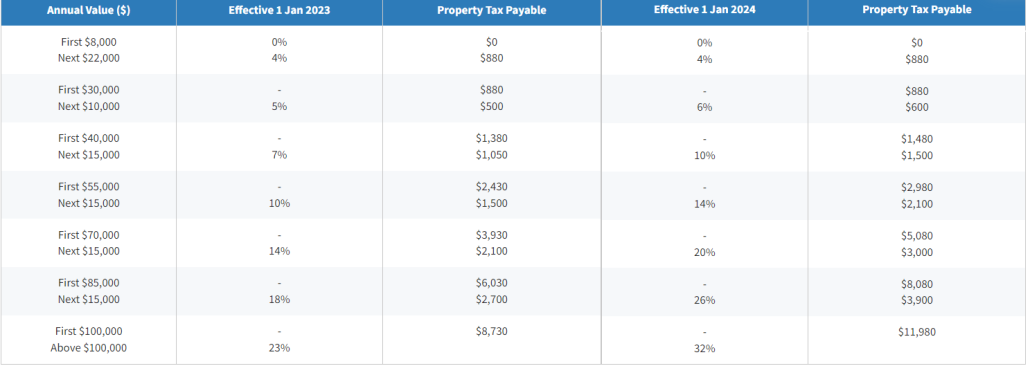

Generally the tax rates of owner-occupied properties range from 0 to 16 and the first 8000 in AV is. Web 1 day agoBuyers stamp duty is a tax paid on documents signed when one buys or acquires property in Singapore. The property tax for owner-occupied residential properties was raised to 5 per cent to 23 per cent from 2023 and 6.

Web The Budget 2023 property tax announcement is expected to raise Singapores property tax revenue by 500 million per year. For example if the. Web This will be automatically offset against any property tax payable in 2023.

Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. Web Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. MyTax Portal is a secured personalised portal for you to view and manage your tax transactions with.

It applies whether the property is occupied by the owner rented out or left vacant. For example if the. The buyers stamp duty rate will increase.

Check Rental Transactions from other Government Agencies. Web Property Tax is a tax on the ownership of immovable properties in Singapore.

Foreigner Buying Property In Singapore Step By Step Guide

Property Tax Singapore Calculate Iras Payment And Annual Value

Singapore Property Costs Lower But Taxes Can Be A Killer Property Market Propertyguru Com Sg

Financing Of Property In Singapore Property Guides Noam Nathan

Buyers Stamp Duty Singapore 2023 ᐈ Calculate Bsd Absd Tax

Property Tax And Permanent Residence In Singapore

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

Higher Property Tax Next Year For Most Hdb Flat Owners Cna

Property Related Taxes When Buy And Own New Development

Singapore Govt Revenue Tax Property Tax Economic Indicators Ceic

Complete Guide To Property Tax For Homeowners In Singapore

Twitter এ Iras Here S A Reminder To Make Payment For Your Property Tax Bill By 31 Jan 2021 Need An Alternative Payment Plan Sign Up For Giro To Pay In Up To 12

Higher Property Tax Next Year For Most Hdb Flat Owners Cna

Property Tax In Singapore 2021 A Guide To Calculating The Rates Financeguru

New Property Tax Budget 2022

Property Tax 2021 Richard Jang Blog

2022 Property Tax Singapore Guide How Much Do You Need To Pay